Originally published on AureusIQ Insights on July 24, 2025

On June 17, 2025, the FDA launched the Commissioner’s National Priority Voucher (CNPV) pilot—a bold new program awarding up to five non-transferable vouchers to companies advancing drugs aligned with U.S. national needs. These vouchers enable 1–2 month FDA reviews, replacing the traditional 10–12 month timeline. Yesterday, a crucial fifth eligibility path—“Increasing affordability”—was added. For the first time, the agency defined this to include either applying Most Favored Nation (MFN)-aligned pricing or reducing downstream medical utilization (e.g., fewer hospital or ER visits) to lower overall healthcare costs.

Read the official FDA statement here.

While the FDA’s CNPV guidance now positions MFN-aligned pricing as a qualifying criterion, its methodology and implementation remains to be further defined. Pharma companies are therefore unlikely to make binding pricing commitments at this time, unless they possess premium pricing leverage (e.g., orphan drugs).

In contrast, “downstream medical utilization” reduction offers a tangible, measurable path: companies can credibly document real-world outcomes—like fewer hospital or ER visits—directly aligned with FDA language, providing a defensible, outcome-driven case for priority review.

This makes the utilization pathway the clearest, most practical eligibility route under CNPV today, while MFN remains a strategy in waiting—subject to future rulemaking and guidance.

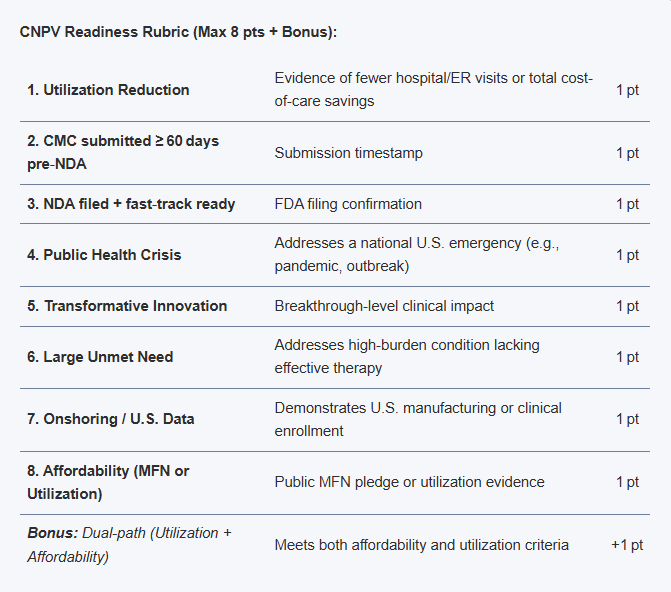

This rubric is meant to identify drug/biologic assets that have a higher probability of qualifying and executing effectively under current CNPV guidance:

CNPV Readiness Rubric (Max 8 pts + Bonus):

| 1. Utilization Reduction | Evidence of fewer hospital/ER visits or total cost-of-care savings | 1 pt |

| 2. CMC submitted ≥ 60 days pre‑NDA | Submission timestamp | 1 pt |

| 3. NDA filed + fast‑track ready | FDA filing confirmation | 1 pt |

| 4. Public Health Crisis | Addresses a national U.S. emergency (e.g., pandemic, outbreak) | 1 pt |

| 5. Transformative Innovation | Breakthrough-level clinical impact | 1 pt |

| 6. Large Unmet Need | Addresses high-burden condition lacking effective therapy | 1 pt |

| 7. Onshoring / U.S. Data | Demonstrates U.S. manufacturing or clinical enrollment | 1 pt |

| 8. Affordability (MFN or Utilization) | Public MFN pledge or utilization evidence | 1 pt |

| Bonus: Dual-path (Utilization + Affordability) | Meets both affordability and utilization criteria | +1 pt |

If you're tracking rare‑disease or high‑cost drugs, we invite you to review and help validate this rubric:

Review the rubric & collaborate

🔒 Content Use Notice: This article is the intellectual property of AureusIQ and is provided solely for informational and research purposes. Unauthorized reproduction, redistribution, or commercial use of this content—whether in full or in part—is strictly prohibited.

By accessing this article, you agree to our Terms of Use. For licensing or citation requests, please contact info@aureusiq.com.

Originally published on AureusIQ Insights on June 24, 2025

As compounded semaglutide gains traction across direct-to-consumer channels, a growing divergence has emerged between branded pricing and what patients are actually paying. With Wegovy reportedly priced at ~$1,300/month through traditional channels and compounded alternatives available for under $300/month, this delta is driving volume toward alternative platforms — and raising new questions about exclusivity, safety, and strategy.

We’re building scenario models, channel pricing monitors, and reimbursement trackers to help investors and access teams quantify strategic exposure in fast-moving therapeutic markets.

Contact us for scenario mapping

🔒 Content Use Notice: This article is the intellectual property of AureusIQ and is provided solely for informational and research purposes. Unauthorized reproduction, redistribution, or commercial use of this content—whether in full or in part—is strictly prohibited.

By accessing this article, you agree to our Terms of Use. For licensing or citation requests, please contact info@aureusiq.com.

Originally published on LinkedIn on May 12, 2025

President Trump recently announced on Truth Social that he will be signing an executive order introducing a “Most Favored Nation” (MFN) pricing model for prescription drugs. While the final details are pending, the policy is expected to reshape Medicare Part B drug pricing — with sweeping implications across the U.S. healthcare landscape and global pharma markets.

In this briefing, we unpack what the MFN order may mean for manufacturers, payers, and patients — and how startups and market access teams should prepare.

MFN pricing pegs the cost the U.S. government pays for certain drugs to the lowest price available in a set of peer countries. The intended goal: bring down domestic drug spending by benchmarking prices internationally.

Historically, this idea has been hotly contested due to concerns around access, innovation, and global market distortion.

Scope: High-cost, physician-administered drugs under Medicare Part B — including therapies like Keytruda, Eylea, Opdivo, and Prolia.

Expected reactions:

This policy isn’t just about cost — it’s about control. MFN pricing could be the start of a broader transformation in how value is assigned across global markets.

We support pharma investors and biotech innovators with pricing insights, regulatory strategy and policy readiness.

🔒 Content Use Notice: This article is the intellectual property of AureusIQ and is provided solely for informational and research purposes. Unauthorized reproduction, redistribution, or commercial use of this content—whether in full or in part—is strictly prohibited.

By accessing this article, you agree to our Terms of Use. For licensing or citation requests, please contact info@aureusiq.com.